Managing Fraud Risk in the Digital Age

AI can bring structure to unstructured data is a scalable and can unearth these threats.

Implementing anti-fraud tools focused on best customer service

Analytics driven tools and techniques needs to be

- Comprehensive

- Real-time

- Cross-Channel

- Cross-Payment

- Enterprise wide and open for integration

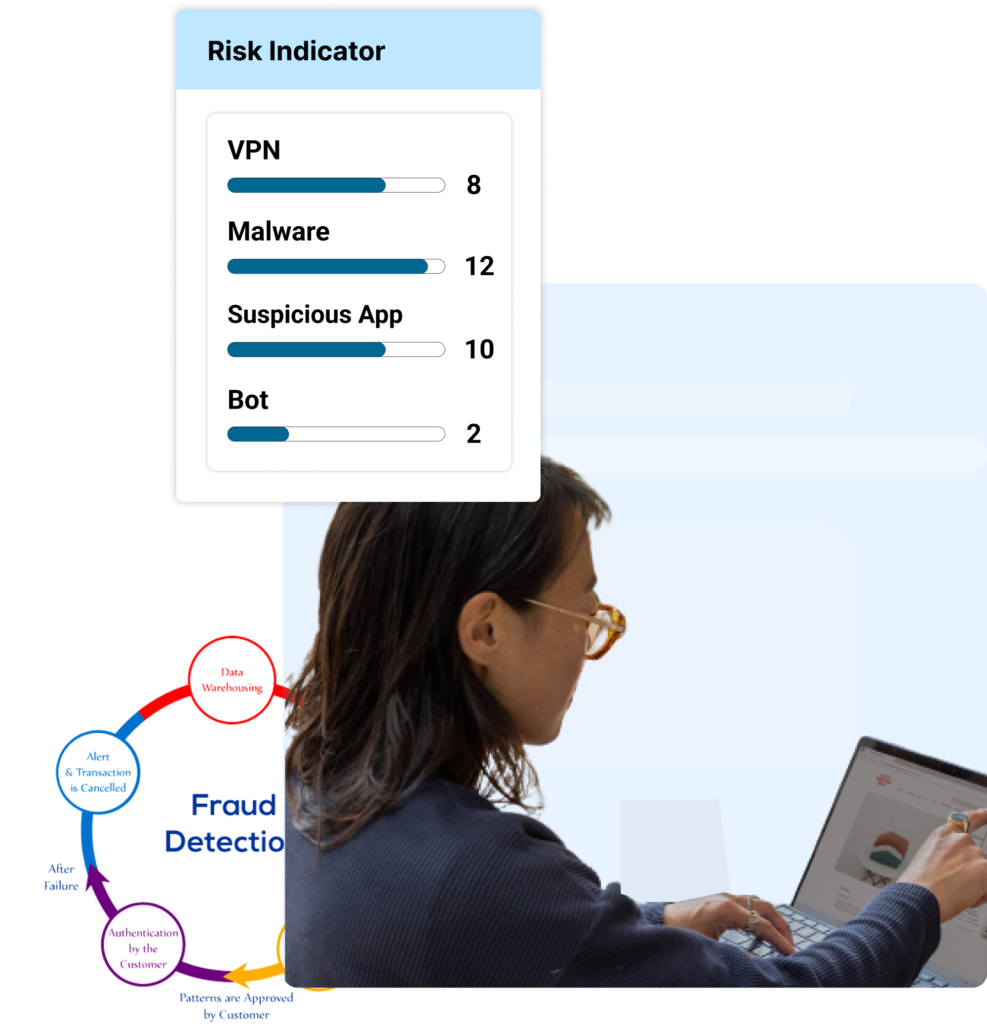

Essentials to prevent fraud in banking sector

- Transaction monitoring with rules and optimized models working all transactions in realtime, ideally with a vision to move to a single customer view.

- Geolocation capability and device ID analysis for mobile and digital banking.

- Network and link analytics for detecting collusion and trade finance fraud and for supporting AML analysis and investigations.

- Integrated alert management, accessible across the enterprise to support triaged alerts and investigations for all financial crimes.

- One-time passwords or biometrics for strong customer authentication.

- Data visualization for at-a-glance identification of potentially suspicious events, activities or connections.

To help organizations Cloud Evolutions partnered with Feedzai to detect and prevent banking fraud before it occurs.

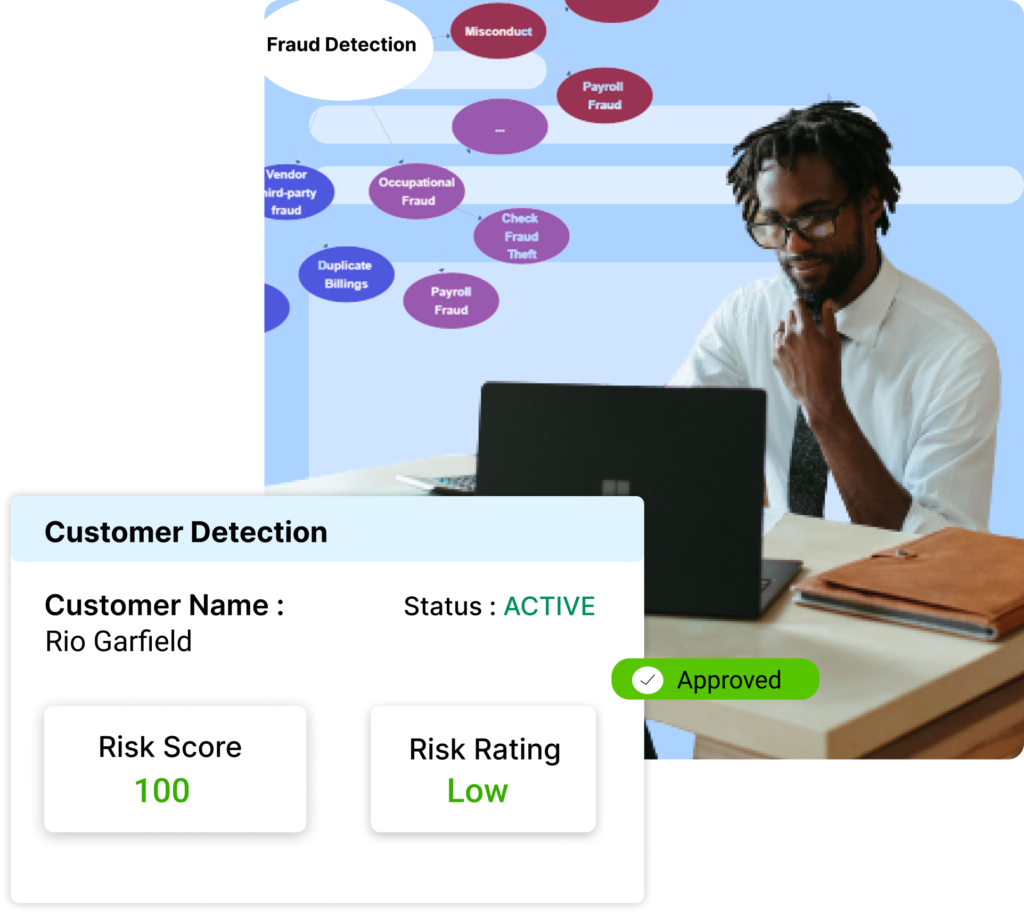

Fraud Detection and Prevention using AI

A single platform for mastering risk across all channels, geographies and payment types. Build trust to help businesses become confident in adapting to the ever-changing financial crime landscape.

Onboard, Verify and Transact

These technologies can be used to analyze and understand data about individual users, allowing for personalized recommendations and experiences.

Prevent Account Takeover

Proactive, Continuous and Silent. Protect customers and build trust by silently detecting bad actors before theya can commit crime

Digital Trust and Safety

Accelerate growth while safeguarding every step of the user journey for the world’s top fintech companies, including the leading crypto exchanges and money transfer services. Secure every transaction, stop fake signups, and improve engagement with Digital Trust & Safety.

Shift the focus from exclusively reducing risk to a balance of protection and growth.

How do you fight fraud currently does it ring a bell?

Natural Language Understanding NLU using AI and Machine Learning

Analyze Complex Documents

Reduce errors, save time, and lower the cost of manual approaches.

Accelerate Intelligent Process Automation

Classify documents and extract data needed to automate language-intensive processes.

Cloud Evolutions Partnered with Expert.ai to offers solutions for AI based NLU

Intelligent Process Automation for Claims and Underwriting

Insurance carriers and brokers handle large volumes of unstructured data that requires collection, processing, understanding, and analysis of large amounts of diverse information. This information can include complex documents such as claims forms, medical reports, accident descriptions and much more.

Expert.ai Insurance Solutions unlock data trapped in complex and variable documents to automate end-to-end claims and underwriting workflows. Powered by decades of collective insurance expertise and knowledge models designed to make it easy to access reusable, secure, compliant, real-world-tested functionality specifically built for insurance companies,

expert.ai technology can read, understand, and extract essential data from medical, accident, submissions, risk engineering, & other reports. Work with the expert.ai team to design highly automated workflows or access secure integrations into systems like Guidewire and Duck Creek.

Key Benefits using AI based NLU platform

Read, understand, and automatically extract essential details from medical and risk analysis reports reducing by 90% hours spent manually reading documents.

Optimize underwriters’ response times by providing them with data and insight contained in submissions to make better decisions, faster to deliver the quote first and generate more wins.

Faster document review leads directly to faster underwriting and claims responses. This results in greater customer and broker satisfaction on every decision.

Improve accuracy and eliminate subjectivity in time-intensive and error-prone claims adjudication process and cut combined ratios by reducing routine erroneous payouts by 5-20%.

Suppress reviews of unnecessary notifications and documents like physical therapy, duplicates, already paid- through date appointments, etc. by 20-30% letting claims reviewers focus on meaningful work.

Contract Life Cycle Management

Integrate

- Ingest contracts from existing systems with pre-built connectors that sync contract data

- Harmonize business systems with connected contract data through API

- Integrate single sign-on authentication to securely provision access

Analysis

- Transform every contract into searchable data with AI trained on 1B+ contract data points

- Track and find critical clauses across all contracts, including third-party paper

- Easily guide Evisort’s AI to find custom clauses unique to your business or industry

Manage & Automate

- Automate data extraction and connect contract data across the organization.

- Manage executed contracts in a secure, searchable repository.

- Get the right document to the right person at the right time with intuitive contract workflows